How payments work

It is important that payments can be made in a safe and efficient manner. From previously having mainly involved a switch in ownership of banknotes and coins, payments have become increasingly complex. All non-cash payments require the involvement of a third party who helps in some way to mediate the payment between the paying and receiving parties. The Riksbank is the hub of the payment system.

Cash payments

Cash payments use banknotes and coins. Payment goes directly from purchaser to seller and no payment service is required from intermediaries for payment to be executed.

Even if no payment services are needed for the actual payment, services are needed to make cash available, which is to say a system for issuing, distributing and redeeming cash. In Sweden, the distribution and redemption of cash is now managed by private actors. Read more about this on the page Cashflow.

Payments in the form of account transfers

All payments not made using cash involve some form of account transfer. Such payments require payment services from intermediaries and an underlying financial infrastructure.

Account transfers using an intermediary

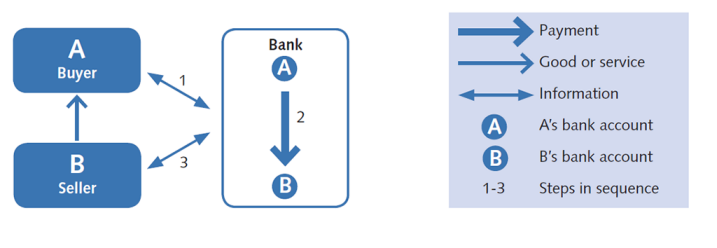

The simplest case is when both buyer and seller have accounts in the same bank. The purchaser then initiates the payment by instructing the bank to transfer a certain amount to the seller’s account. The bank executes the requested transfer and informs the seller that their account has been credited.

Example of a payment using an intermediary

Account transfers using several intermediaries

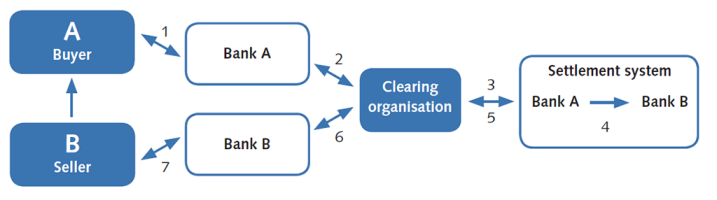

Often purchaser and seller have accounts with different banks, which means that several actors must be involved in the payment. In addition, further financial infrastructure is required to mediate information about the transaction between all involved parties and to transfer money from the purchaser's bank to the seller’s bank.

In the example in the figure below, the purchaser initiates payment by instructing their bank to transfer an amount to the seller (1). Bank A must then somehow transfer money to Bank B. The exchange of information between the banks usually takes place via what is known as a clearing organisation, which processes the information and mediates it between the banks. Bank A therefore sends payment information to the clearing organisation (2). This makes things easier for the banks, as they are mediating a large number of payments and would otherwise have to exchange information with a large number of actors (3). Once the information has been processed, instructions are sent to a settlement system in which both banks have accounts and where the final transfer of money between purchaser's bank and seller’s bank is made. The settlement system can most usually be found in the central bank, where all banks have accounts (4). A confirmation of the transfer is sent to the seller’s bank via the clearing organisation (5, 6), after which the seller’s bank credits the seller’s account and informs them that the money has been received (7). This process usually results in a time gap, as the seller does not receive the money in their account until, for example, the day after the payment was initiated. Some institutions are now offering what are called instant payments (for example Swish), where the time gap shrinks to a number of seconds and it is possible to send money from bank to bank around the clock.

Example of a payment using several intermediaries

Important intermediaries

In Sweden, the settlement of all payments going from an account in one bank to an account in another bank is done by moving money between these banks' accounts at the Riksbank. This reduces the risks associated with settlement because the Riksbank can neither have liquidity problems – that is, not have the money to make a payment at some point – nor go bankrupt. If settlement were instead to take place at a third bank, there would be greater risks in that this bank could both encounter liquidity problems and enter into bankruptcy. The Riksbank’s system for settlement is called RIX.

The account payments are not usually settled one by one. Instead, a clearing organisation (in Sweden Bankgirot) usually combines a large number of payments at certain fixed times, which are then exchanged as payments in RIX. This means that payments in RIX are fewer than the payments made via all the different accounts in the different banks every day. In some urgent cases, a bank can send a single payment via RIX at the Riksbank at the request of a customer.

The Riksbank provides a service for the settlement of instant payments in Swedish kronor, RIX-INST. RIX-INST enables customer payments to be settled between banks in real time, 24 hours a day and all year round in central bank money. The service is based on the Eurosystem’s TARGET Instant Payment Settlement (TIPS) platform. Today, payments from the mobile application Swish are settled on RIX-INST and RIX-INST participants can also offer their customers the possibility of sending and receiving other types of instant payment in accordance with the Nordic Payments Council Instant Credit Transfer (NCT Inst) payment framework.

Apart from the companies mentioned above, there are a whole series of companies offering services related to account payments.

Thanks for your feedback!

Your comment could not be sent, please try again later

Questions? Visit our FAQ on kundo.se (opens i new window).