How we pay affects the cost

NR 2 2023, 23 mars

How we pay affects the cost

Published: 23 March 2023

Swedes prefer to pay digitally, for example by card or the Swish payment app. An important explanation for this is that the digital alternatives are perceived as simple and convenient.[5] See, for example, the Payment patterns in Sweden 2022 and the Payment Inquiry’s survey on payment habits in 2021 (in Swedish). Digital payments have also become more convenient in recent years. To pay in a shop, it is now often enough to tap your card on a payment terminal instead of inserting the card and entering a PIN. For online purchases, it is often possible to use the Swish app or enter your card number to easily make future card payments.

Non-digital payments such as cash and postal giro require a lot of manual handling, which means that they generally require significantly more time and other resources than digital payments. It is therefore not particularly surprising that the total social cost of payments has decreased as the use of digital payments has increased. This is also something that previous cost studies have shown.[6] See Bergman et al. (2007) and Jansson and Segendorf (2012).

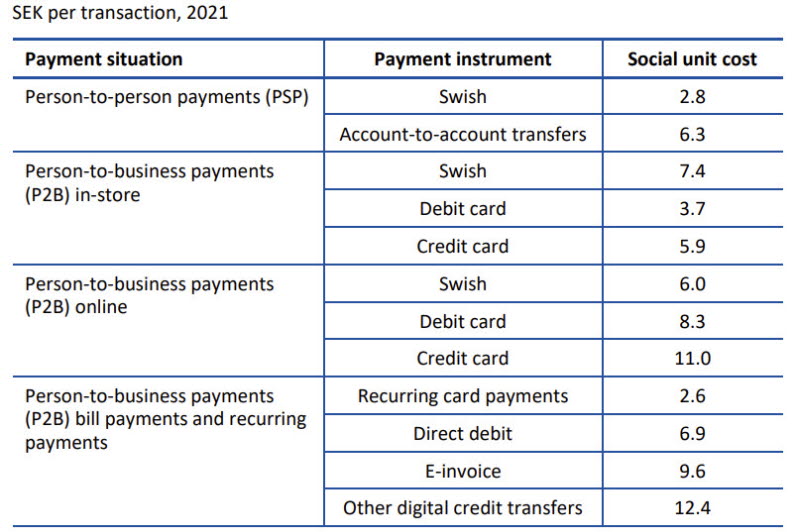

The Riksbank's Cost Study shows that the difference in the social unit cost of different payment instruments is considerable, even in the same payment situation.[7] See the Riksbank (2023). This is an important result because it demonstrates the possibility of making the payment market more efficient. In general, payments with debit cards and instant payments such as Swish are both faster and require fewer resources than payments with, for example, credit cards and credit transfers initiated via mobile or online banking. The differences are illustrated in Figure 1 below. To a large extent, the differences relate to the fact that some digital payments take less time for the actors involved, but there are also differences in the number of actors involved in each type of payment. In addition, different payments require different types of physical equipment and IT systems.[8] For a more detailed description, see the Riksbank (2023). A further factor is how many payments are made with each payment instrument. The payment market is generally characterised by high fixed costs combined with low marginal costs per transaction. This means that there are economies of scale that lead to a payment instrument with many transactions having a lower cost per transaction than a payment instrument with few transactions.

Note. The light blue bar for Swish is a subpart of credit transfers.

Source: The Riksbank (2023).If we dig a little deeper and look at some individual payment situations, the difference in the social unit cost of the various digital payments becomes even greater. As we can see in Table 1, for example, the social unit cost of making an account transfer to a private individual via a mobile phone or online bank is more than twice as high – just over SEK 6 – compared with a Swish payment that costs just under SEK 3.

The social unit cost, that is the cost per transaction, for a Swish payment in a physical store is SEK 7.4. This is almost twice as much as for a payment by debit card. However, Swish has not yet had a full impact on physical trade. There are many shops and other businesses that do not accept Swish, and among those that do, Swish payments are often not fully integrated with the cash register system. Therefore, it often takes longer to make a Swish payment in a physical store than a card payment. This is an important explanation as to why Swish payments are still used to a low extent and have relatively high social unit cost compared with other digital payments in physical stores. With more efficient payment solutions at physical points of sale, the social unit cost of Swish payments could become lower than it is today.

For online purchases, however, Swish is most cost-efficient with a social unit cost of SEK 6 compared with a credit card payment that costs SEK 11. For paying bills and invoices, an e-invoice has a lower social unit cost – SEK 9.6 – compared with “ordinary” bill payments initiated via mobile phones or online banking, which cost SEK 12.4. For recurring payments such as subscription services, rent or monthly bills, recurring card payments are clearly the cheapest alternative with a social unit cost of just over SEK 2.5, compared with direct debit and e-invoice, which cost SEK 6.9 and SEK 9.6 per transaction respectively.[9] In recurring card payments card details are entered once and the payee can then initiate payments on an ongoing basis via the registered card.

Note. Card payments (P2B) also include payments between businesses (B2B). However, card payments initiated by businesses only constitute a small amount of the total number of card payments and will thus have a limited effect on the results.

Source: The Riksbank (2023).Economic Commentary

NR 2 2023, 23 mars

Download PDF