The framework for the Riksbank's equity in the new Sveriges Riksbank Act

The new Sveriges Riksbank Act (the Sveriges Riksbank Act (2022:1568)) that entered into force in January 2023 contains a new framework for equity. The framework aims, among other things, to safeguard the Riksbank's financial independence. The Riksbank's equity constitutes, together with outstanding cash (currency in circulation), the Riksbank's interest-free debt which contributes to increasing the Riksbank's earnings. This means that when the equity is sufficiently large, earnings will be good enough for the Riksbank to be self-financed.

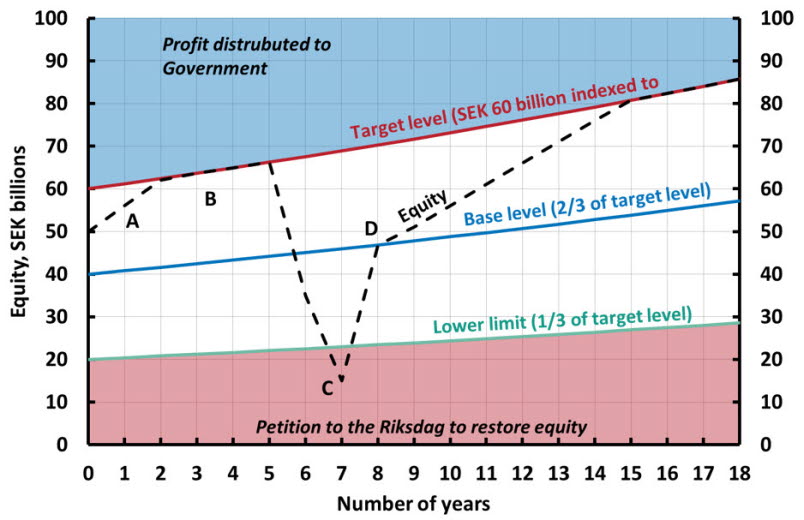

The Sveriges Riksbank Act contains rules for the size of the Riksbank's equity, for the distribution of profits to the state and for the restoration of equity if necessary. A central part of the new act is that there is a defined target level for equity. The target level is set at SEK 60 billion and is intended as an appropriate upper limit for equity. The level is adjusted upwards by inflation each year (“CPI indexation”). The law also defines a basic level and a minimum level for the Riksbank's equity. The basic level is set at two-thirds of the target level, i.e. SEK 40 billion, and the minimum level is one-third of the target level, i.e. SEK 20 billion.

This is how the different levels of equity in the Sveriges Riksbank Act interact

When the Riksbank makes a profit, this leads to an increase in equity. If the profit leads to equity exceeding the target level, the excess capital is distributed to the state. If equity falls below the target level, any profits are transferred to equity to build it up towards the target level. If equity is lower than the minimum level, the Riksbank shall submit a proposal to the Riksdag to restore equity. As a main rule, restoration shall then be made to the base level, but it can be made all the way up to the target level if this is necessary to ensure the Riksbank's capacity for self-financing in the long term. The different cases are illustrated in the figure and described with examples below.

Figure: Schematic illustration of the framework for the Riksbank's capital in the Sveriges Riksbank Act

The black dotted line in the figure illustrates a hypothetical development of the Riksbank's reported equity over a number of years. The figure also illustrates the Sveriges Riksbank Act's framework for equity: If equity exceeds the target level (red line), the excess amount shall be distributed to the state. If equity exceeds the base level (blue line), profits shall be used to build up capital towards the target level. If equity is lower than the minimum level (green line), the Riksbank shall submit a proposal to the Riksdag to restore equity.

Building up equity (A in the figure): In years 0 to 2, the Riksbank's reported equity is lower than the target level and any profits shall be transferred to equity to build it up to the target level (i.e. there will be no dividend paid to the state). Rules on the Riksbank's equity are contained in Chapter 8, Sections 8-10 of the Sveriges Riksbank Act.

Distribution of profit (B in the figure): In years 3 to 5, part of the profit is transferred to equity to compensate for the increase in the target level in line with the CPI, but the excess profit is distributed to the state. The regulations concerning this are contained in Chapter 8, Sections 12–14 of the Sveriges Riksbank Act.

Petition to restore equity (C in the figure): In years 6 and 7, the Riksbank makes losses and equity falls below the minimum level (one third of the target level). In this case, the Riksbank shall make a petition to the Riksdag to restore equity. As a main rule, the Riksbank shall request a restoration up to the basic level (two-thirds of the target level). According to the Sveriges Riksbank Act, a proposal shall also take into account any unrealised gains (booked in separate revaluation accounts), which could justify a restoration to a lower level. However, if justified on the basis of financial independence, the Riksbank may request that the capital be restored all the way up to the target level. The rules for restoring equity are contained in Chapter 8, Section 15 of the Sveriges Riksbank Act.

Restoration of equity (D in the figure): In year 7, the Riksbank receives a capital injection from the Riksdag. In this example, equity is restored to the base level (D in the figure). During years 9 to 15, the government does not receive any dividend payments because equity is below the target level. Instead, the profits made by the Riksbank are used to gradually build up equity to the target level again. As the capital increases, the Riksbank's earning capacity improves.

Annual report and petition to Parliament

According to the Sveriges Riksbank Act, each year the Riksbank must prepare an annual report for the past year, which is submitted to the Riksdag, the Swedish National Audit Office and the General Council of the Riksbank by 21 February each year. With the new Sveriges Riksbank Act, as of 2024 the General Council of the Riksbank will decide on the allocation of profits and the Riksdag will then approve the decision.

The annual report for the financial year 2022 was prepared and adopted in February 2023 and is published on the Riksbank's website. For the financial year 2022, the Riksbank has made a loss of SEK 81 billion. According to the accounting rules in the Sveriges Riksbank Act, the result for the year will not affect equity until the annual report for 2023. The annual report for the financial year 2023 will in turn be prepared and decided by the Executive Board and submitted to the Riksdag in February 2024. Based on the Riksbank's loss for the financial year 2022, the Riksbank assesses that equity will be negative and amount to minus SEK 18 billion for the financial year 2023. The Riksbank therefore needs to submit a petition to the Riksdag to restore equity no later than in connection with the annual report for 2023. (Similar to point C in the figure above.)

Once a petition has been submitted to the Riksdag, there is a process where the Riksdag considers and decides on the petition before any recapitalisation takes place.

Thanks for your feedback!

Your comment could not be sent, please try again later

Questions? Visit our FAQ on kundo.se (opens i new window).