Greater financial risks for the Riksbank

NO. 8 2022, 4 July

Greater financial risks for the Riksbank

Published: 4 July 2022

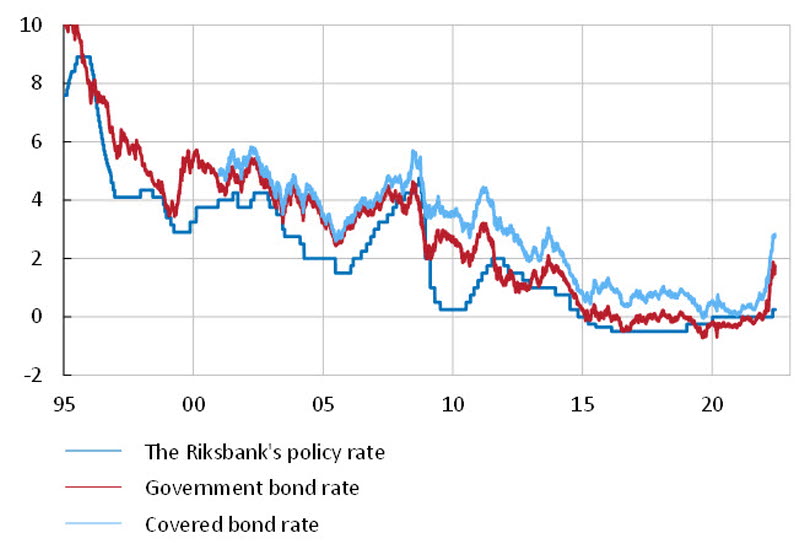

A large balance sheet with a large bond holding on the asset side increases the risk of financial losses.[6] Read more about this in, for instance, “FACT BOX – The Riksbank's financial results are affected by interest rate changes" in Sveriges riksbank (2022a, s. 23), Sveriges riksbank (2021b) Sveriges riksbank (2022f) and Sveriges riksbank (2022b). The bonds held by the Riksbank normally have a maturity and a fixed interest term of several years.[7] A small part of the Riksbank's bond holdings in kronor has a short fixed interest term with variable coupons, i.e. the return if you keep the bonds to maturity is not known in advance but depends on how the short-term interest rates develop. However, since most of the bonds have a long fixed term with fixed coupons, we use this as a base for our reasoning in this Commentary. During the period of asset purchases, both policy rates and market interest rates have been low in Sweden and globally, see Figure 3. When market interest rates now rise from these low levels, it means that the market value of the Riksbank's bond holdings falls.

It is, however, important to be clear that the objective when a central bank buys bonds is not to make a profit. The aim of the Riksbank's asset purchases has been to stimulate the economy and to maintain confidence in the inflation target. The Riksbank's assessment is that the financial losses for the Riksbank are expected to be less than the positive effects of the asset purchases (see simple calculation examples concerning possible effects on public finances in section 3.1 below).

The market value of the bonds can therefore vary, but if the bonds are held until they mature, the return is known throughout the period and therefore independent of the market value of the bonds. At the same time, the purchases of securities are financed by increasing the Riksbank's interest-bearing debt, see Figure 2. The Riksbank's purchases have been paid with newly created money in the Riksbank's RIX payment system (where the banks make payments between themselves and with the Riksbank). The payment for the bonds is made to the accounts of monetary policy counterparties in RIX and these funds are then deposited with the Riksbank on an ongoing basis. The interest that the Riksbank pays to its counterparties for this debt is variable and linked to the Riksbank's policy rate. This means that changes in the policy rate affect the Riksbank's interest expenditure.

Note. In this figure, the category of gold and foreign currency reserves also includes IMF assets. Assets in SEK include the Swedish bond holding, loans to the banks, and other assets. The interest-free liability includes equity, provisions, revaluation accounts, and bank-notes and coins. Other liabilities are classified as interest-bearing liabilities. This includes mainly deposits in SEK and current currency liabilities to the Swedish National Debt Office.

Source: The Riksbank.

The large bond holdings with a long maturity, that were financed with increased deposits in SEK, thus entail a substantial risk for the Riksbank's financial results.[8] A part of the Riksbank's foreign exchange reserve is also comprised of long-term bonds financed with increased deposits. The risk is clearly illustrated by recent developments with rapidly rising inflation, market interest rates and, to a certain extent, policy rates, which have resulted in a marked decline in the market value of the Riksbank's bond holdings in a short space of time. For example, during the first four months of 2022, the current market value of the Riksbank's asset holdings in SEK has decreased by more than SEK 40 billion. This type of interest-related risk is something the Riksbank has been well aware of and also communicated during the period of bond purchases.[9] See, for example af Jochnick (2015), Flodén (2016), Flodén (2018), and the decision-making documents for Sveriges riksbank (2021a) and Sveriges riksbank (2022d).

Note. Bond rates refer to synthetic zero-coupon bonds with a maturity of 5 years.

Sources: Macrobond and the Riksbank.

Economic Commentary

NO. 8 2022, 4 July

Download PDF